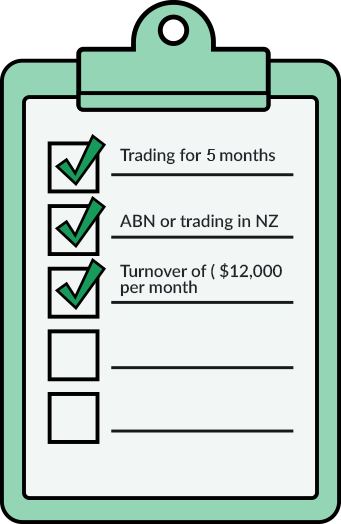

We like to keep things simple, and so is our criteria for an

unsecured business loan.

Use our check list and tick the boxes to ensure you meet

the requirements for an unsecured business loan for your

business today.

An unsecured business loan means the business can

obtain funds without having to provide any form of

collateral. Providing collateral when financing means that

you are offering an asset you own in terms of security

when it comes to meeting your repayments. An asset can

include property, vehicles, stock/inventory and more.

Receive a decision in a matter of minutes

Submit your online

application form, here.

Finding yourself in a situation where you owe money to the Australian Taxation Office (ATO) can be stressful for any business owner. Yet, it's a reality that many face. ATO debt doesn't have to spell the end of your dreams and ambitions, thanks to ATO debt loans. These loans offer a financial breather, enabling you […]

In our latest case study, we spotlight a Financial Advisory business in Neutral Bay, Sydney, faced with the challenge of exiting a constraining loan. Traditional lending avenues had proven ineffective for the stockbroker-turned-director in need of $1.5M for his residence. Simply Funds crafted a bespoke solution, leveraging multiple lenders to structure a combined first and […]

Our case study showcases an Accounting Firm from the Northern Beaches of Sydney, grappling with a high-interest loan in default. The firm's director, needed a lifeline to not just save his residential property in Elenora Heights but also to secure additional capital for business growth. Traditional lenders were not an option. Simply Funds stepped in, […]

In this detailed case study, we delve into how Simply Funds provided a lifeline for a Panel Beater business in Carringbah, Sydney. Faced with excessive monthly payments on loans for two residential properties, the director sought a solution to ease cash flow and steer his business back towards stability. Traditional financing routes were not an […]

Seeking financing for your business? Partnering with business loans brokers could be the key to unlocking a world of opportunities. In this blog post, we’ll explore the role of business loans brokers, the advantages of using one, and how to choose the right broker for your needs. Let’s dive in! Key Takeaways Understanding Business Loan […]

Are you an entrepreneur or business owner seeking funding for your venture? Navigating the world of business financing can be daunting. But worry not - this comprehensive guide will help you secure the funds you need to grow and succeed. We’ll cover a variety of financing solutions, tips for assessing your financial needs, and strategies […]

The process of obtaining a loan secured by property can be overwhelming, and it's no surprise that many people get confused about the different types of mortgages available. Three common terms that often get mixed up are caveat, first mortgage, and second mortgage. In this article, we'll explore the differences between these types of mortgages […]

What will 2023 bring for the Australian Economy? Interest rates are expected to rise further, home prices are predicted to continue falling, and the demand for refinancing is projected to increase, especially with the looming cliff of fixed-rate mortgages ending. But what does this mean for brokers, borrowers, businesses and property owners? Here's a look […]

Running a business means there’s lots on your plate. Everyday is a new obstacle, task or problem that you need to source a solution for. When it comes to funding your business and sourcing finance, we’ve made finding a solution easy for you. This article outlines the four types of loans you should know about. […]

When seeking funding in the form of a loan, it is important to understand a range of key concepts that apply to lender assessed financial products.

Challenges are a daily occurrence in the world of business. More often than not, business owners mistakenly view these challenges as an obstacle rather than an opportunity.

When it comes to short term business finance, one of the most difficult tasks faced by business owners is finding the product that will best suit their needs.

If you require additional cash flow for your business or other personal reasons, using the equity in your property may be a viable option. Contrary to the thoughts of many, you can use personal real estate which has an existing mortgage as security for a loan provided there is equity available.

The world of business continues to evolve, and the lending space is no exception. There is an increasing demand for secured loans which has brought about changes in many areas.

Whether to invest in working capital, upgrade premises or facilities, purchase equipment or buy property, a second mortgage loan (or Caveat Loan) can provide money in less than a week from application to released funds.

Getting a business loan with major financial institutions such as banks can take weeks, or even months. Simply Funds has this problem by providing fast loans for business.

Securing funding through traditional lenders such as banks can be a lengthy and rather complicated process.

A low credit score is not the end of the road

Throughout the course of running a business owners are faced with difficult decisions and constant challenges. Among those are decisions relating to cash flow management, and more specifically, business finance.

Caveat loans (https://simplyfunds.com.au/blog/fast-caveat-loans/) are a financial solution for businesses, particularly useful for start-ups and commercial property investors. A caveat loan is a fast funding loan that is secured against a property. I

We’ll assess your application fast and get you an answer (and the funds you need) quickly.

Simply select the amount you're looking to borrow, click on the button below and fill out the

form. Our friendly team will respond to your enquiry as soon as possible.

A Bizcap provides both Unsecured and Secured loans to Small Business Owners. When assessing a loan application Bizcap generally doesn't take into consideration if a prospective customer has specific assets to provide as security. However:

(a) if the loan amount is above $30,000 (or any other figure which Bizcap determines from time to time), Bizcap will, under the loan agreement take a charge. For a corporate borrower and any corporate guarantor, the charge is over all of that entity's present and after-acquired property (that is. the security is not over specific assets but any and all assets which the entity may have). For a sole trader borrower and any individual guarantor, the charge is over its current and future real property; and

(b) in certain instances, for example, where the loan relative to the cash flow of the borrower is of a size that warrants the provision of security over specific assets. Bizcap may require specific security to be granted over those assets. Bizcop may register its security interest(s) under relevant legislation, including the Personal Properties Securities Register and the register held under the Real Property Act 1900 (NSW) or Its equivalent.

I n addition. Bizcap may take personal guarantees from directors of corporate borrowers, directors of corporate guarantors and certain individuals. No registrations are made in respect of guarantees.

Simply Funds operates an online information service that seeks to introduce Australian businesses to potential funders. Simply Funds does not provide any credit, financial products, or financial advice – either to individuals or businesses.

© 2024 Simply Funds. Web development by Dimo .